Halloween is coming up, and it’s a great chance for party rental business to increase their earnings. With good planning and financial support, your business can do well this season. This article looks at how small business loans can help you get ready for Halloween and keep your rental business running.

Understanding the Halloween Demand

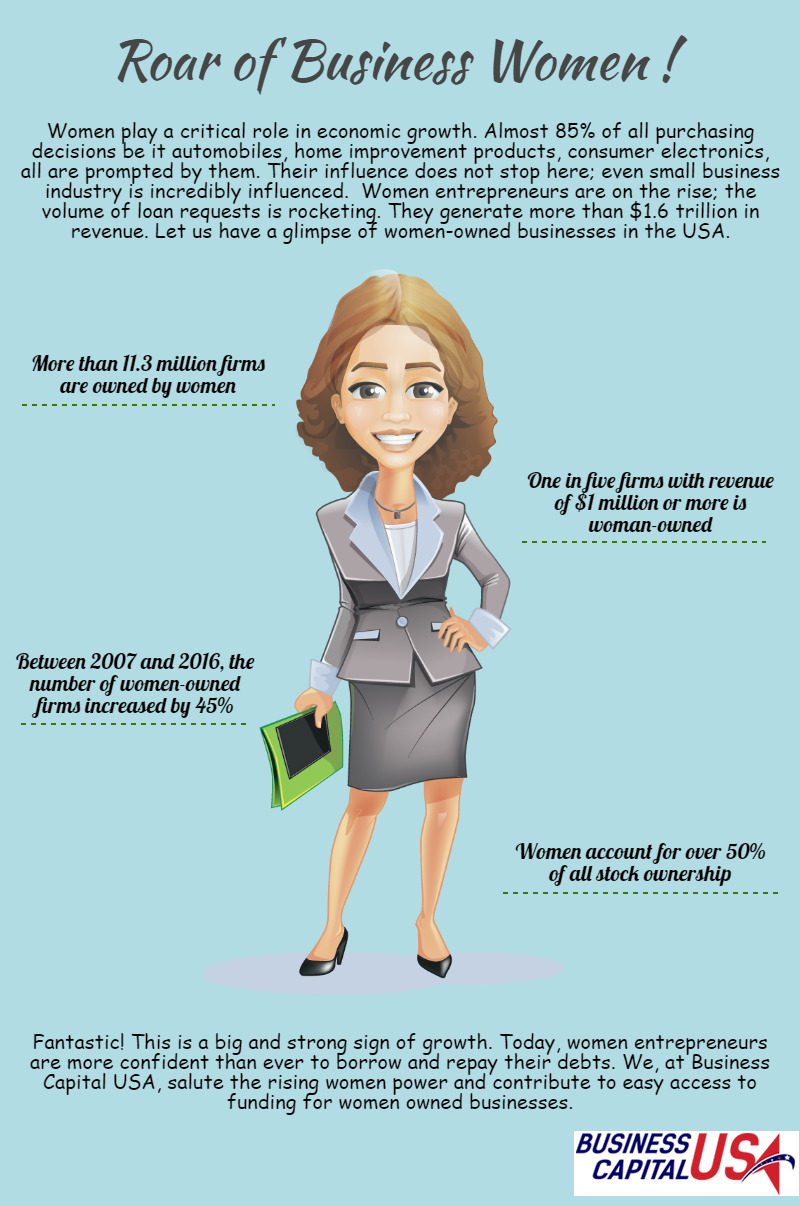

Halloween is one of the biggest celebration events, creating a surge in demand for party rentals. Business Capital USA is an excellent option for party rental businesses. We offer flexible loan solutions designed to meet the unique needs of small businesses. Here’s what you need to know about their offerings:

The Importance of Financial Preparation

To meet the increased demand, your business might need extra inventory or marketing efforts. This can include purchasing new rental equipment, enhancing your website, or investing in social media advertising to attract more customers. Without enough funds, it can be challenging to seize these opportunities. An answer to this problem can be found in the form of small business loans.

Why Consider Small Business Loans for Your Party Rental Business?

Small business loans give you extra money to invest in your business. This way, you can grow without using up your savings. A loan may be an option for you if you meet the following criteria:

Buy Equipment: As Halloween approaches, you might want to invest in new rental equipment, such as themed decor, inflatable Halloween attractions, or extra tables and chairs. A small business loan can help you buy these items and expand your inventory.

Enhance Marketing Efforts: With increased competition during the Halloween season, a well-planned marketing campaign is essential. Use your loan to improve your website, run ads on social media, or create promotional materials. This will attract customers looking for party rentals.

Manage Cash Flow: Seasonal fluctuations in income can make cash flow management tricky. A small business loan can help you get through slower months. It provides the money you need to cover your everyday costs.

Increase Staffing: If demand increases, you might need to hire more staff to handle tasks like setting up equipment and helping customers. A small business loan can help you pay for these temporary workers, keeping your business running during busy times.

Business Capital USA: Your Financial Partner

When considering a small business loan, Business Capital USA is an excellent option for party rental businesses. We offer flexible loan solutions designed to meet the unique needs of small businesses. Here’s what you need to know about their offerings:

Eligibility Criteria

Ensure you meet the following eligibility criteria before applying for a loan with Business Capital USA:

- 1 year in business

- Monthly revenue of at least $15,000

- A Social Security Number must be owned by the business owner

- A valid Business Tax ID / EIN

- Availability of 3 months of bank statements

Getting Started with Your Loan Application

At Business Capital USA, we offer easy and hassle-free funding solutions for your party rental business. You can access funds without delay thanks to our streamlined application process, which ensures quick approval.

- Apply online: Complete our straightforward online application

- Get approved: Once we’ve received all necessary documents, we’ll approve your loan.

- Get funded: Access your funds within 24 hours of approval.

Halloween is coming, so it’s a great time to get your party rental business ready for the increased demand. Small business loans from Business Capital USA can give you the financial support you need to succeed this season. By planning ahead and getting the funds you need, you can ensure your business is ready for a successful Halloween!